Stimulus stimulus stimulus. But how? And where do we get the money?

The FED has been very mediocre when stimulating the economy since 2008. I know that stock markets (until recently) were at record levels, unemployment was low etc. I am not saying they were unable to somewhat ‘goose’ these numbers with their policies, but the amount of money they had to spend and manipulate in order to create this perceived growth and strong economy would show their ideas were poorly executed. Yet up to this point the market has always believed they would bail them out.

And the FED will, if it can figure out how to do that. But the FED’s biggest weapon, the ability to lower interest rates, is almost out of ammunition. Their last rate drop only worried the market, and that market has already priced in the next anticipated rate cut of 25 basis points in their next meeting.

Today the FED announced a 500 Billion repo program to open up liquidity for smaller businesses and short term borrowers. The market reacted very positively, erasing almost 1200 points of losses in the matter of a few minutes. Yet 40 minutes later, the market had erased all the positive momentum from the FED’s announcement. The market finished down 10%, the worst day since 1987.

The market has seen all the measures offered by the FED at this point to be insufficient to overcome the fears of the Coronavirus and it’s impact on global economies. Every day that impact is growing. No more NBA basketball, no March Madness, no St. Paddy’s day parades, no more spring training baseball, no more Hockey; all of those announcements made in the last 24 hours. The overall impact of this pandemic will take time to truly quantify it’s impact to both the markets and our daily lives, but things will likely get worse before they get better. What actions will the FED take next in order to curb this fear?

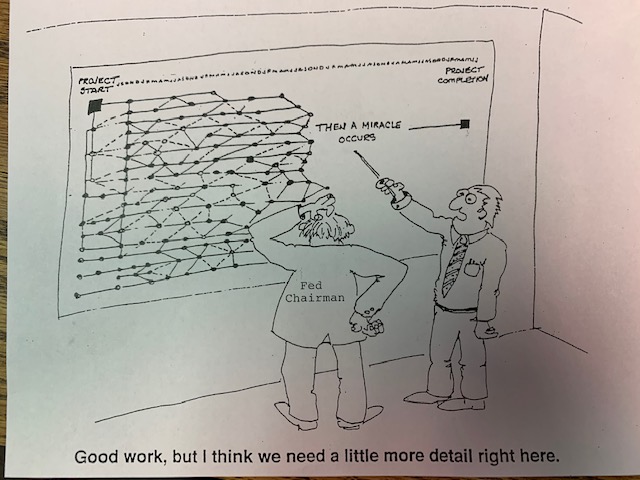

We don’t think the FED or Trump really have the tools left to stimulate this economy giving the current conditions. At this pace, airlines will need a bailout, travel will need a bailout, and tons of small businesses who relies on public consumption will need a bailout. The FED has very little room left to drop interest rates. The corporate bond market is in a lot of trouble as well.

To be clear, we would not want to be the chair of the FED. The actions of the FED have spurred all time highs in the market, and until recently, most headlines were about our growing and stable economy. But those actions have created issues with overpriced stocks and artificially low interest rates. The FED has created one of the largest bubbles in stock market history, they can’t just let it crash. Investors seemed content with the overpricing as long as interest rates stayed low and the world kept on turning. Enter an unforeseen circumstance, such as the Coronavirus and and the environment changes dramatically.

Risk level is one way an investor can hedge against these types of events. Asset allocation reviews can help investors identify which areas they are taking risk at, and is that risk appropriate for their situation? Feel free to call us @ (303) 770-3030 to review your accounts. Also please feel free to visit our website @ http://www.valuefinancialadvisers.com to review our previous quarterly newsletters expressing concern about the market and what is coming next. (Before the Coronaviurs)